King

James Bible Investments was established as a place for family,

friends, acquaintances and other Christians to be informed

about world market conditions and as a place to preserve

their capital by investing in the only form of real money,

gold and silver. King

James Bible Investments was established as a place for family,

friends, acquaintances and other Christians to be informed

about world market conditions and as a place to preserve

their capital by investing in the only form of real money,

gold and silver.

Biblical records show that gold and silver are the first

and oldest form of money, the only money that has not failed,

and a source of omega replica notable value for over 5000 years! Can you

name one fiat currency that has lasted through even a few

centuries let alone a few millennia like gold and silver?

We think not!

Biblical

reasons why real money and wealth is gold and silver

-

The

Hebrew word for money is “keceph”, which is translated

to mean “silver.”

-

The

King James Bible mentions gold 417 times, silver 320

times, and money, which is mentioned 140 times, refers

to physical silver and gold. Not once does it mention

a paper currency.

-

Gold

and silver are mentioned all through the bible as real

wealth, even through the end of Revelation.

-

From

Genesis to Revelation, gold and silver are the only

God-ordained monetary assets that will maintain their

purchasing power until the day of the Lord’s wrath.

Biblical Gold

Don Stott

Gold is the first, and most frequently mentioned metal

in the Bible, as at Genesis 2:11. From the beginning, it

has been a noble metal, highly valued for its weight, rarity,

durable non-tarnishing luster, shimmering beauty, ductility,

and malleability. A number of Old Testament Hebrew terms

refer to gold, such as zahav, charuts, kethem, paz, seghor,

and ophir. In the New Testament, the Greek words khrysos

and khrysion are used as reference to ornaments, coins,

and gold in general.

Gold's rarity, throughout history, and even in Biblical

times, gave it a monetary value, which made it useful in

commercial transactions, as well as a measure of wealth

and prominence. The color and luster of gold, and its resistance

to oxidation or tarnishing, makes it valuable for jewelry

and ornamentation of all kinds. In early Biblical times,

it was found in its native purity in gravel deposits and

riverbeds. It was easily separated and recovered because

of its great weight. In the book of Job (28:1,2,6) mining

and refining operations are mentioned.

In the construction of the Tabernacle, built by Moses,

Exodus 25, 30, 37, and 39 describes using gold being beaten

into plates for overlay, sheets, and even thread used in

garments used by the high priest. In The Most Holy, the

Ark of the Covenant, was gold.

Solomon's Temple, extensively used gold in its d飯r.

As is done with several modern coins, even ancient Israel

evidently mixed an alloy with gold to harden it. (I kings10:16).

David set aside 100,000 talents of gold for Solomon's Temple.

A talent is about 75 pounds! The Temple's lamp-stands, utensils,

forks, bowls, pitchers, basins, cups, etc, were all made

of gold and silver, with a very few being made of copper.

The cherubs in the Most Holy, the alter of incense, and

even the entire inside of the house was overlaid with gold.

By today's prices, the gold in Solomon's Temple would probably

be valued at $50 billion.

Solomon received large amounts of gold from the King

of Tyre (120 talents), the Queen of Sheba (120 talents),

and from taxes and revenues from his own merchant fleet.

First Kings says that the weight of gold that Solomon received

in one year, was 636 talents of gold. The incredible amount

of gold that was transacted and used in David and Solomon's

day is unbelievable…but true.

When Israel captured cities, God commanded that they

not use the captured gold and silver for themselves. Evidently

the captured gold was re-refined to purify it. The exception

was Jericho. Its gold and silver were turned over to the

priests and used for sanctuary use, according to Jos. 6:17-19,

24.

Gold was so valuable and cherished, that in the Bible,

gold is likened to wisdom, faith and knowledge. Psalms says

that God's laws and commandments are more desirable than

gold. (Psalms 19: 7-10, 119:72, 127) Psalms also says that

while gold has great value, it is unable to give life. (Psalms

49: 6-8) Job says that no amount of gold can buy the wisdom

that comes from God. (Job 28: 12, 15-17,28) The Apostle

peter said ones' faith is of greater value than gold, which

can withstand fire, but be worn away by other means. (I

Peter 1:6,7) No amount of gold can deliver one in the day

of God's anger. (Zep 1:18) The point is that gold is the

most valuable thing one can possess, according to the Bible,

other than knowledge, faith, life, and righteousness.

Even in Biblical times then, TANGIBLE WEALTH, as opposed

to spiritual wealth, has always resided in gold, and silver.

Throughout recorded history, gold and silver have been actual

wealth, as opposed to currencies made of various things,

such as mulberry leaves, bark, cigarettes in WW II, sea

shells, and other trivia, but mostly PAPER. History, in

all faiths and in all books of wisdom, and various holy

books, have all used gold and silver as the ultimate form

of tangible wealth. In all races, and throughout all of

recorded history, gold and silver have been wealth, stability,

and irrefutable riches.

Today, as well as in past history, governments, kings,

rulers, and charlatans of all types, sizes, and sorts, have

used paper "instruments," as the sophisticates call them,

to hoodwink, steal, and defraud innocents. Be they paper

dollars, promises from hundreds of treasuries throughout

history and the world, or worthless bonds and stocks. All

such "instruments," are as good as the issuers of such,

and no more. A piece of paper, with scribbling or a beautiful

imprimatur, is only as valuable as its issuer. An IOU on

a piece of scrap paper, given you by a trustworthy individual,

is far more valuable than a million pieces of currency from

a bankrupt kingdom or nation.

Promises from a used car salesman or government bureaucrat,

can be honest or dishonest; valuable or worthless. The same

is true with papers of all sorts. A home is a tangible thing,

which can be lived in, raise kids in, sleep in, love in,

and die in, but a piece of paper can be destroyed with the

flick of a match. Tangible vs. fluff, in other words. Leadville

Johnny Brown, on a cold morning on Fryer Hill, in Leadville,

Colorado, burned a hundred thousand paper dollars, when

he started fire in his stove. Molly had hidden it there

so he wouldn't waste it. Gold and silver won't burn, and

if Molly Brown had hidden an equal amount of gold and silver,

Johnny couldn't have started that fire.

It continually amazes me, that by far the majority of

all populations of all nations, throughout history, have

believed the empty promises of their elected officials and

leaders. The common man, has always been fooled by those

richer, smarter, or better dressed than themselves. They

have gone along with the shallow plans and edicts, and used

their rulers monies to save. They have sent their kids to

their ruler's public schools, while they sent their own

to private ones. The majority, has usually been wrong in

all matters of state, it seems. Throughout history, this

has been so, be it in Biblical or modern times, the majority

has usually been proven wrong in their choices of rulers

or savings devices. When everyone does something, I usually

do just the opposite. I look at all the new cars whizzing

by my door, and am appalled at the wealth poured into them.

They lose value with every mile. My three old Mercedes ('73,

'74, and '85) give me great joy, incredible reliability

and economy, and go up in value with each month. My two

'41 Plymouths, equally. New cars, T bills, bonds of any

kind, and paper dollars, are absolutely the worst thing

one can do with surplus assets.

If you are religious or an atheist, one can determine

from any holy book or history, but especially the Bible,

that gold and silver are true tangible, physical wealth,

which will not burn, and have never lost their desirability,

or ability to purchase things. Gold and silver have always

been a measuring rod to determine value, and compare things

with, or scads of graphs and charts wouldn't be comparing

how many stocks one can buy with gold, or how many dollars

it takes to buy gold and silver. When long lost ships are

discovered beneath the oceans or seas, their recovery isn't

for their rudders or deck planking, which long ago have

disappeared. It is for the gold, which after a thousand

years beneath the briny deep, is still brilliant, beautiful,

and untarnished. History is not wrong.

I am always amused by the expression, "When everything

else fails, try reading the directions." Us guys hate reading

directions or asking for advice or directions when we are

lost. We think we are so damned smart. My clients and other

dealers' clients may be, but most guys and gals are as dumb

as wedges when it comes to investing and protecting themselves

is concerned. They all consort with their advisers who have

fancy offices and nameplates on their doors, with diplomas

neatly framed on the walls. When one is a "licensed financial

advisor," one might think that they might contact me occasionally,

rather than the continual in and out of stocks and bonds.

Not so. One might think that the majority of people everywhere,

might notice that "Gold Medal Flour," or the Lone Ranger's

horse and bullets, weren't named for dollars or euros. When

an Olympic medal winner stands proudly to receive his or

her award, they aren't given hundred dollar bills. They

are given the gold medal. Yet the public continues to ignore

what continually stares them in the face, and even in the

Bible's pages. Gold and silver are true wealth, with which

to protect yourself.

Why would someone want to buy real gold or silver or

other precious metals?

Why would someone want to buy real gold

or silver or other precious metals? There are two primary

reasons. The first is that coins or bars of these metals

have a durable, tangible and intrinsic value which derives

from their future utility in industry as well as their perceived

value as a financial instrument. Owners of precious metal

coins or ingots may use them as a form of savings, but they

sacrifice an interest on the savings, since such coins and

ingots bear no interest. An important counterpoint to the

loss of interest is that the asset value of each coin does

not correspond to an obligation of another party which may

be defaulted. The second reason to own precious metal coins

is to have an asset which is private or anonymous. One man

may choose to spend $100 on a dinner out, the other may

choose to buy $100 worth of gold. The one man has spent

his money, the other has saved it, privately. Although we

live in a computerized world with ever less financial privacy,

the owner of a precious metal is exercising a long tradition

of financial privacy.

An observation which justifies the ownership

of precious metals as a form of savings is that over time,

all printed monies of all nations tend to experience inflation.

Prices rise slowly, and the purchasing power of the money

falls slowly. Governments and their citizens tend to enjoy

inflation at low levels since it allows them to pay long

term debts back with inflated currency. A positive side

of mild inflation is that it tends to encourage savers to

place their money into interest bearing investments and

assets such as homes and stocks, in the hopes that the value

of their investments will grow faster than inflation. A

corollary to that is that everyone knows that only a fool

would stuff their money into a mattress for 20 years. But

precious metals, over the long term, tend to generally hold

their value just about even with inflation. There are occasionally

periods where the value of precious metals does not rise

with inflation, but those are usually followed by periods

where the price of the precious metals rises, sometimes

suddenly, and usually finds a new equilibrium price near

the level dictated by inflation.

For persons living in smaller countries

where governments have a history of destroying the value

of the currency, precious metals, primarily gold, represent

an asset which can easily be sold but which will not suddenly

lose value in a currency collapse. Even in modern times,

families in many nations in economic trouble have been able

to preserve their savings, through holding that savings

in gold, rather than their local currency. Those families

did not do this by suddenly converting their savings into

gold during a financial collapse, they did this during the

good times preceding the collapse, by slowly buying gold

each time they had spare savings.

Small countries who get into trouble with

their national debt, and print up a lot of new money trying

to fix things, and then see a dramatic collapse in the value

of their currency, are usually able to let a bunch of folks

go bankrupt, borrow a few billon dollars from the International

Monetary Fund, print a new currency and start over. They

are usually much more concerned about arranging bailout

loans than they are about the option to confiscate gold

or regulate or tax sales of gold.

America is in a very different situation.

We are already borrowing about $500 billion dollars per

year from foreigners. This is about 5% of our entire economic

activity (GDP). If America would get in trouble with the

national debt, print up a lot of new money trying to fix

things, and then see a consistent drop in the value of the

currency, yes, many of us could go bankrupt, but who would

bail us out??? If the dollar upon which we all have relied

is losing value, the central banks of the world might prefer

that Americans begin to save in other currencies such as

Yen and Euros, but just as likely is that Americans begin

to consider saving in gold. If this happens, the US Government

and Federal Reserve Bank will certainly see that a rush

away from dollars and into gold, by American citizens, is

a vote of no confidence for the dollar. The temptation will

be to restrict and regulate gold markets for Americans,

trying to force them into holding dollars. But the real

solution is for the Government to manage its spending and

the FED to manage back real trust in the dollar.

The situation in silver is even more dramatic.

Near the end of World War II, since America had been a large

silver producer, and had also accepted silver as payment

for war supplies, the United States Treasury (including

circulating coin) and the US Strategic Silver Reserve held

close to 10 billion ounces of silver. Since then, silver

has become an essential component in thousands of modern

products, and even though the amount of silver mined each

year has grown, the demand for silver has grown so much

faster, that most of those 10 billion ounces of silver reserve

have been used up. As a matter of fact, the ongoing availability

of silver from reserves has tended to keep the prices for

silver low, and so the global mining industry has not made

large new investments related to silver. In essence, the

world has been experiencing a shortage of silver for several

decades, and this has been hidden by the consumption of

reserves. Now, those reserves are gone. Silver known to

exist in vaults is only about 150-500 million ounces…2%

to 5% of the reserves we once had. Enough to cover a couple

short years of typical silver deficit, but that is not enough

time for the global mining industry to build mines to produce

an extra 200 million ounces per year of silver. A shortage

of silver is now eminent. Certain silver investors have

recognized the emergency situation in silver several years

ago.

The situation with silver is that an acute

shortage of silver (leading to certain industrial companies

closing down production lines if they can’t find silver)

may now occur almost simultaneously with inflationary erosion

in the value of various global currencies, particularly

the dollar, and a trend away from financial investments

such as stocks and bonds into commodities such as energy,

food, lumber, metals, etc. In any financial environment,

the rise in price caused by an acute and structural shortage

in silver will attract new interest in silver investment,

but this could even be more dramatic in a poor economic

environment where inflation is once again high. Many of

the world’s poorest nations are still prolific savers. If

even 1% of the savings generated in one year were to attempt

to invest in silver, the price of silver would easily move

to over $100/ounce. Historically, most serious investment

advisors would advise owning about 10% of an investment

portfolio in precious metals. If Americans now tried

to convert even 1% of their portfolios into silver, massive

increases in silver prices could occur.

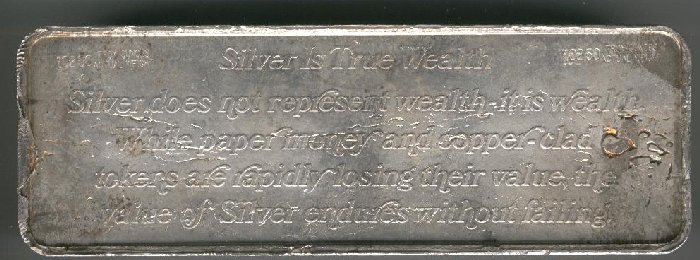

Did you know

that in 1980, 7 of these 100 oz. bars could buy a comfortable

house? Silver at it's sustained peak was valued at about

$45 / oz. It's now around $6 / oz. Will silver go up in

value or will real estate prices decline? Perhaps both will

occur. Regardless, wouldn't you like to own some physical

silver and buy a house with it in a few years?

“Great

opportunities are not seen with your eyes. They are seen

with your mind. Most people never get wealthy simply because

they are not trained financially to recognize opportunities

right in front of them.”

- Robert T. Kiyosaki

- Rich Dad/Poor Dad.

MORE VALUABLE THAN GOLD?

By James R. Cook

When I started Investment Rarities thirty-two

years ago, silver analyst Jerome Smith was already a legend.

In those years he made a series of price predictions for

gold, silver and platinum that were phenomenally accurate.

In 1967 he recommended his readers buy silver at $1.29 an

ounce. In 1971 he recommended gold at $42.00 an ounce. In

1977 he recommended platinum at $147 an ounce immediately

before it shot up to $1,000. In his 1982 book Jerome predicted

that within our lifetimes silver could very well be worth

more than gold. I recently revisited that prediction to

determine the exact basis for which Smith had made this

amazing claim.

In the 1970s Smith and silver were synonymous.

Here’s how he described his uncanny track record. "In 1972,

when I wrote the results of a five-year study of silver

in a book that has since been regarded as ‘the bible’ on

silver, I said that in the coming decade, ‘silver would

double in price and then double again.’ Only a few of the

many who read that in the early 1970s believed me. And I

was wrong. Instead of doubling twice, it doubled three times

over on an annual average price basis."

In 1980 silver climbed to $50 and fell

back to under $8 the ensuing year. Then in 1982, Smith claimed,

"I expect the price of silver to be in the $100-plus per

ounce range by 1985." Smith based this bullish conclusion

on five primary causes.

- Industrial demand for silver was exploding.

- Mining production of silver was less than consumption.

- Silver production couldn’t be greatly ramped up

because 75% of new silver came as a byproduct to base

metal mining.

- Since silver was used in such small amounts in its

many applications, a price rise in silver would not

reduce the demand.

- The government had sold off most of its two billion

ounce hoard in a way that kept the price down. Now that

it was gone, free market forces would re-establish the

true price at much higher levels.

Smith went on to predict, "Fundamentally,

the outlook for silver is more bullish from 1982 on than

for any other commodity I know of – including the much-ballyhooed

strategic metals. Silver in 1982 is a cheap precious metal

on the way to becoming a scarce and expensive strategic

precious metal within this decade."

How could this premier silver analyst,

who had so accurately predicted the price rise for silver,

gold and platinum in prior years, miss the mark so widely

in the 1980s? For one thing, his 1972 book on silver was

read by the Hunt Brothers, who claimed it was instrumental

in their driving up the price of silver. In that sense,

his accurate prediction was a self-fulfilling prophecy more

than it was a shortage of silver. To some extent, Smith

underestimated the above-ground supply of silver going forward.

However, the greatest reason that Smith’s

predictions failed to come to pass has been outlined many

times by today’s premier silver analyst, Theodore Butler.

In the 1980s, the world’s supply of above-ground silver

was rapidly being depleted and the price should have been

moving higher rather than stagnating. Ted Butler became

the first analyst to pinpoint why. The world’s remaining

stockpiles of silver, mostly in foreign government hands,

were being leased out and then sold off at low prices. This

selling kept the price depressed. In this process, the silver

market was oversupplied. No thought was given to getting

the best price. Free market mechanisms that would have lifted

the price of silver were overwhelmed by a glut of silver

sold off by the banks and brokers, who leased the silver

from foreign governments and others. They sold it off differently

than would the true owners. They were more interested in

the silver lease rate than the price. Some might even have

wanted the price to stay low.

Ted Butler also pointed out a second

crucial fact. A few large trading houses and banks had been

able to get a stranglehold on the silver futures market.

Their finances dwarfed the size of the silver market, and

it was highly profitable to take the short side of futures

transactions and cash in when the price dropped. (They could

sometimes engineer the drop by lowering their bid prices.)

This could also be highly profitable for them in writing

options.

These two artificial market tactics acted

somewhat the same as price controls. Ted Butler has pointed

out that, by holding the price down, these manipulations

have made silver all the more attractive to silver buyers

because of the resulting low price. In that sense, he echoes

Jerome Smith’s claim that the market always has its way.

Said Smith, "The longer and greater the interference, the

more sudden and precipitous the market reaction will be.

All the more quickly prices will move all the lower or all

the higher – opposite the direction of the control

– to bring the demand made and the supply offered into balance."

This is what Ted Butler means when he says the price of

silver must explode.

In the spring of 1972, I first read Jerome

Smith’s influential book, Silver Profits in the Seventies.

Probably no paragraph I ever read influenced me more than

these words, "Truly outstanding investment opportunities

occur only occasionally. In general, the better they are,

the rarer they are. Such opportunities are normally long

term in their maturation and by careful study can be foreseen

long before they come to the attention of most investors…..

The very highest profit potentials occur whenever there

is a convergence of two or more primary causes. Such as

is with silver today."

Fast forward to 2004 and, more than ever,

silver has a number of primary causes for extreme bullishness.

Not the least is a dangerously low world supply of silver.

We are likely on the eve of a critical shortage, and the

price doesn’t reflect that fact. This shortage has been

camouflaged by an artificially low price brought about by

leasing, and by the big Eastern market makers’ chokehold

on silver in the futures market. (Market-making is supposedly

not allowed.) This is why Ted Butler says that silver offers

the greatest opportunity for gain that most people will

ever have. Usually a shortage is made visible by the price.

Not this time. Today’s silver price signals nothing. We

will run out of the world’s most crucial metal without any

warning (except from Ted Butler) and the price will have

to explode. The silver shorts and the silver users will

be blindsided.

One thing Jerome Smith never contemplated

is the huge increase in demand from India and Asia for consumer

products that use silver (electronics, appliances, autos,

etc.) This skyrocketing demand means that the deficit between

silver produced and silver used will remain a problem into

the future and aggravate the coming price rise. Furthermore,

the booming growth in world populations means that, by definition,

this metal, so critical to modern civilization, will be

utilized all the more.

Nor did Jerome Smith anticipate that

the U.S. government would sell off every last ounce of the

billions of ounces of silver they once owned, including

the 100 million ounce stockpile for military and strategic

purposes. He would have enjoyed the fact that the government

(which he disdained) now finds it necessary to buy the silver

they need for their coinage programs in the open market.

One thing that Jerome Smith forecast

seems to be happening only now. He assumed that, because

of money and credit expansion, a rise in the inflation rate

would cause investors to pour into silver. We’ve been inflating

for decades and, for one reason or another, it is just beginning

to catch up with consumer prices. People are definitely

buying more silver than they were a few years ago. The silver

story is getting out, and the surge in buying will definitely

impact the price. In the future these private buyers could

very well be the source of silver for desperate industrial

users.

Jerome Smith also made this observation

about the price ratio of silver to gold. "Both gold and

silver emerged in markets as money and served as money,

by weight, long before any government put an imprint on

either metal. A 16-1 ratio, or close to that, held from

the 4th century B. C. until the last quarter

of the 19th century – over 2,000 years. The markets

quickly adjusted to the 16-1 ratio when gold was set free

in 1968, and again in 1980." Now the ratio of silver to

gold is 60-1. A return to the historic ratio would put silver

at $25 per ounce.

From the early 70s to this day there

have been numerous claims that silver usage in photography

would be replaced by new technology. In today’s era of digital

photography, the cheaper throw-away cameras still hold a

huge market share. Jerome Smith seemed to be looking ahead

to this day when he wrote about "new consumer products co-existing

with earlier similar ones while total market demand for

old and new increases."

Jerome Smith was a best selling author.

On the book jacket of his Silver Profits in the 80’s,

there is the following paragraph written by me. "Since I

have prospered as a consequence of Mr. Smith’s predictions,

it is natural to continue to give significant weight to

his current sentiments… If Mr. Smith’s predictions are correct

(and his forecasting record demands that we pay heed) silver

may be the best single investment opportunity any of us

may ever be faced with."

It didn’t work out that way. By 1985

I had given up on silver. I switched my company’s emphasis

to gold, and kept it there for fifteen years. Then in the

summer of 2000 I came across the writings of Ted Butler.

He explained why silver hadn’t lived up to its promise.

He showed why Jerry Smith was more right than wrong. He

exposed the price manipulation of silver and presented a

powerful argument as to why the price of silver was bound

to rise dramatically. Ted Butler replaced the late Jerome

Smith as the dominant thinker in the silver market.

Ted Butler has added fuel to the fire.

He has shown that leasing is bogus. He has argued that the

short sellers will be squeezed and the manipulation must

be broken. He has suggested that the industrial users will

panic when they see a shortage in the silver supply and

will have to buy silver no matter what the price. He has

pointed out the necessity of holding actual, physical silver

to get the greatest gain with the least risk.

Will silver be more valuable than gold

some day, as Jerome Smith suggested? There’s around four

billion ounces of gold above ground and around one billion

ounces of silver. All that gold is worth 200 times the silver.

Yet 150% of each year’s silver mine production is necessary

for vital industrial purposes. Most of the silver ever mined

is used up and gone forever. There’s been a silver shortfall

every year for 20 years but the price has failed to reflect

this, despite the fact that a shortfall is one of the most

powerful influences in establishing a price. Ted Butler

believes that silver is the most undervalued commodity on

earth today, and perhaps ever in history. Jerome Smith was

right about silver’s promise. It may not overtake gold as

he suggested, but nobody who owns it today is likely to

ever complain.

“Great

opportunities are not seen with your eyes. They are seen

with your mind. Most people never get wealthy simply because

they are not trained financially to recognize opportunities

right in front of them.”

- Robert T. Kiyosaki - Rich Dad/Poor Dad.

Acknowledgments

to all those who were instrumental in the construction of

this website.

-

Arne

& Lila Britz – Parents

-

Bonnie

Britz – Technical help

-

Mohamed

Ghaleb – Technical help and friend

-

Jason

Hommel -- Jason Hommel of www.linkjesus.com is a fellow

Christian who understands how the unjust fiat money

system is doomed for judgment and that silver and gold

will find favor again as a true form of wealth. He has

a rare combination of understanding gold and silver's

role in biblical application and relation in today’s

fiat money system.

-

Norm

Franz – Biblical economist who has an extensive background

in business development. As a former monetary economist

and investment company president, Norm is a recognized

authority on money and wealth. His recent book, Money

and Wealth in the New Millennium, is an eye-opening

read and prophetic for today’s world economic situation.

I strongly suggest that every Christian who has any

interest in finance, the stock market, or money in general

read his book!

Bible Investments

631-728-4133

|